The FHA is making some changes to the UMIP, or Up Front Mortgage Insurance Premium, effect October 4, 2010. The premium, which is charged at closing and added into the principal value of the loan, is being reduced from 2.25% to 1%. The monthly Mortgage Insurance Premium, which is added into the monthly payment, is going to increase. The amount of the increase depends on the loan-to-value of the loan.

What does this mean to you?

The lower premium up-front will reduce the overall amount you owe when purchasing or refinancing a home with an FHA loan. For example, on a $200,000 loan, the up-front premium would drop from $4,500 to $1,000. Assuming someone put 5% down ($10,000), the principal due would drop from $194,500 to $191,000. Their montly payments would, on average, increase by about $60.

Wednesday, September 15, 2010

Friday, September 3, 2010

Fannie Mae Pushing Lenders to Foreclose

Fannie Mae is going to beging giving fines to lenders who do not comply with their established timelines for completing a foreclosure. In a report to investors, Fannie Mae stated that vacant properties not currently listed "represent a shadow inventory putting downward pressure on both home prices and rents."

If you are behind in your mortgage payments, you have options...but you need to act quickly. Over 2 million homeowners were in foreclosure in July. Give me a call (360-977-8329) and we can talk about your options.

Read the full article here.

If you are behind in your mortgage payments, you have options...but you need to act quickly. Over 2 million homeowners were in foreclosure in July. Give me a call (360-977-8329) and we can talk about your options.

Read the full article here.

Thursday, September 2, 2010

Pending Home Sales Rise

The National Association of Realtors released pending home sales data from July this morning. Pending sales increased 5.2 percent over the previous month. Most analysts had predicted that pending sales would drop by just over 1 percent. Lawrence Yun, the Chief Economic for NAR, cautioned that despite the good news, recovery will take time. "Home sales will remain soft in the months ahead, but improved affordability should help with a recovery...For those who bought at or near the peak several years ago, particularly in markets experiencing big bupbbles, it may take over a decade to fully recover lost equity."

Affordabilty is the combined impact of home priced and interest rates (currently below 4.5% on a 30-yr fixed).

Read the full NAR release here.

Here's an article from Forbes, discussing the news.

Affordabilty is the combined impact of home priced and interest rates (currently below 4.5% on a 30-yr fixed).

Read the full NAR release here.

Here's an article from Forbes, discussing the news.

Wednesday, September 1, 2010

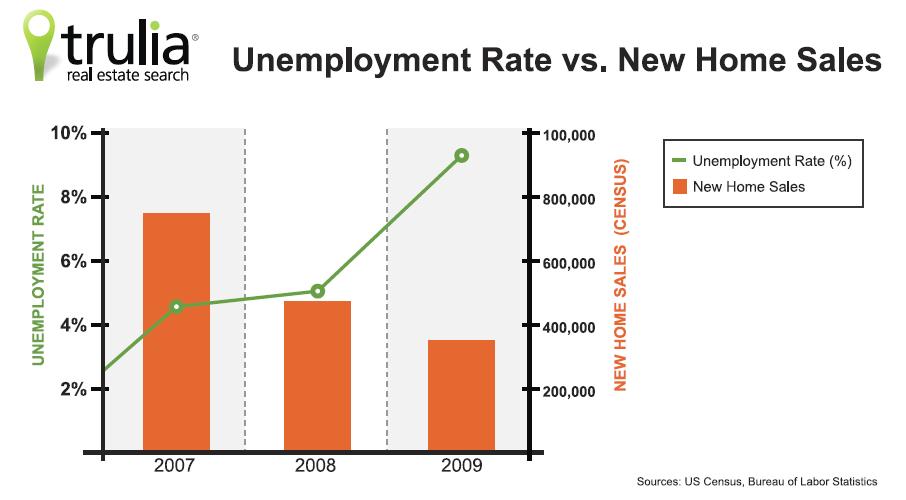

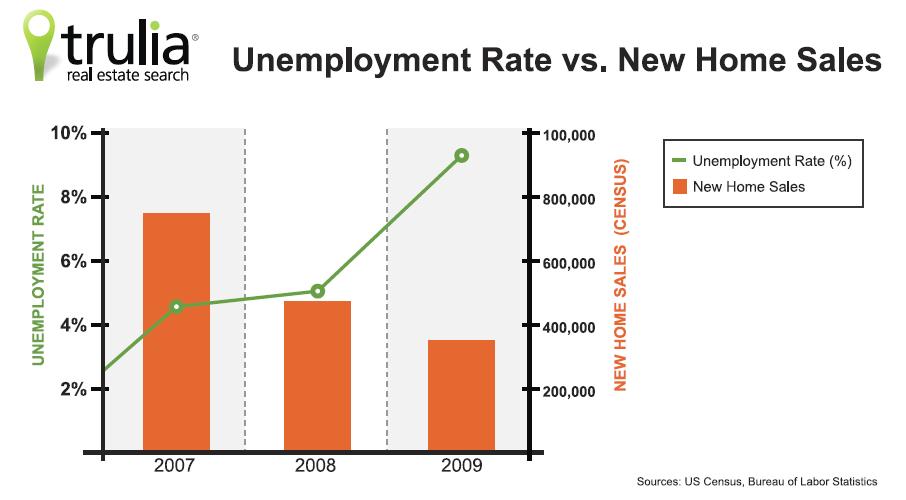

American Dream Report

Trulia.com and Harris Interactive recently released a report titled "The American Dream," that discussed consumer sentiment regarding homeownership. Some highlights from the report:

If you would like a copy of the full report, send me an e-mail at johnblom@hasson.com.

- 19% of those surveyed have a more negative view of homeownership than they did 6 months ago, compared with 23% who have a more positive view

- In 1950, the average home was 983 square feet; in 2004, this increased to 2,349 square feet. In the future, most builders say they plan on building smaller, less expensive homes.

- 72% of those surveyed stated that owning a home was part of their American dream

If you would like a copy of the full report, send me an e-mail at johnblom@hasson.com.

Is NAR Counter-productive?

A friend of mine (hat tip to Luke) e-mailed me this blog post and asked my opinion. Basically, the blogger argued that the National Association of Realtors (NAR) consistenly optimistic take on the housing market is counter-productive, in that it makes it more difficult for realtors to get sellers to set a reasonable listing price for their home. It's an interesting idea, so I thought I would put in my two-cents :

If you are considering buying or selling a home, I recommend looking at what NAR is saying about the market, but also looking at the Wall Street Journal or the NY Times, as well as the Columbian or Oregonian to get a couple different perspectives. If you have specific questions, call me. For some people, now is not the right time to make a move. If I think you should wait a year or two (or five), I will tell you. I would rather be honest with you and earn your trust (and hopefully your business whenever the time is right), then try and talk you into a bad decision.

- I don't think that NAR's statements have created an overly optimistic market. Many of the sellers I have talked to recognize that we are still in a difficult market, and that it is going to take awhile to recover. Sure, there are a few that believe their home is worth more than it probably is, but I think this has as much to do with the rapid increase in prices during the housing boom that conditioned people to think a certain way about home values.

- As the other blogger states, NAR is an advocacy group for realtors, so it should not come as a surprise that they tend to emphasize positive news in the real estate market. Consumers should consider where information is coming from when making such an important decision as buying/selling a home.

If you are considering buying or selling a home, I recommend looking at what NAR is saying about the market, but also looking at the Wall Street Journal or the NY Times, as well as the Columbian or Oregonian to get a couple different perspectives. If you have specific questions, call me. For some people, now is not the right time to make a move. If I think you should wait a year or two (or five), I will tell you. I would rather be honest with you and earn your trust (and hopefully your business whenever the time is right), then try and talk you into a bad decision.

Subscribe to:

Posts (Atom)