Thursday, December 23, 2010

New Market Data

Thursday, December 16, 2010

Clark County Foreclosures Down in November

Wednesday, December 15, 2010

Price Reduction - 15802 NE 43rd St - $180,000

PRICE REDUCED!!! This amazing deal is not a short sale or bank owned. This home features lots of living space with a formal dining and living room, plus a large kitchen with eating area and family room. Upstairs has three bedrooms and two full bath, plus a bonus room over the spacious three car garage. Set in a quiet, East Vancouver neighborhood just blocks from 5 acre Fir Garden Park. Click here for the full listing. Call, text, or e-mail me to schedule a showing.

HomeSteps Smart Buy Program

- A two-year home warranty that covers repair or replacement of covered systems due to regular wear and tear.

- An appliance purchase discount that saves you 30% on new appliances.

This program only applies to certain properties and the home being purchased must be for use as a primary residence. For more information on the program, go the Smart Buy Website.

For a list of homes that qualify for this program, send me an e-mail at johnblom@hasson.com or call me at (360) 977-8329.

Best Christmas Light Displays in Vancouver

Central Vancouver

- 4009 NE 65th St (Freimuth)

- 1601 X St (Russell)

- 11212 NW 9th Ave (Blanca and Moore)

East Vancouver

- 16304 NE 63rd St (Whitehead)

- 2517 NE 176th Ave (Holloway, 2 more great displays just down the street)

- 11806 SE Riverridge Drive (Peppers)

- 7207 NE 92nd Ave (Kirschenmann)

- 4506 NE 106th Ave (Porter and Hubbard)

Orchards/Brush Prairie

- 13210 NE 93rd (Gertz)

- 20306 NE 68th St (Livingston)

- 9109 NE 109th Ave (Burnett)

West Vancouver

- 11111 NW 19th Ave (Kay)

East County

- 2707 NW LEadbetter Parkway, Camas (Giel)

- 4430 NW Crystal Ct, Camas (Pfeiffer)

- Sunset Ridge Subdivision, Washougal, along 51st St (community)

Sends pics/videos of your favorites and I will be sure to post them!

Happy holidays!

Tuesday, December 14, 2010

East Vancouver New Construction - Parkside Court

- Hardwood Floors

- Granite Counters

- Stainless Appliance Package

- Customizable Plans

- One-stop Home Design Center

15802 NE 43rd St - 2417 SF - $199,900

Great fixer opportunity!!! Not a short sale or bank-owned. This home sits on an amazing 16,000 square foot lot in quiet, established community. Don't miss this opportunity -- call today!

Great fixer opportunity!!! Not a short sale or bank-owned. This home sits on an amazing 16,000 square foot lot in quiet, established community. Don't miss this opportunity -- call today!- 2417 square feet

- 3 bedroom/2.5 bathroom

- 3 car garage

- Bonus room over garage

- 16,000 square foot lot

- Formal living/dining room

- Kitchen opens to eating nook and family room

- Nice sized laundry room

- RV Parking

- Very Private

Thursday, December 9, 2010

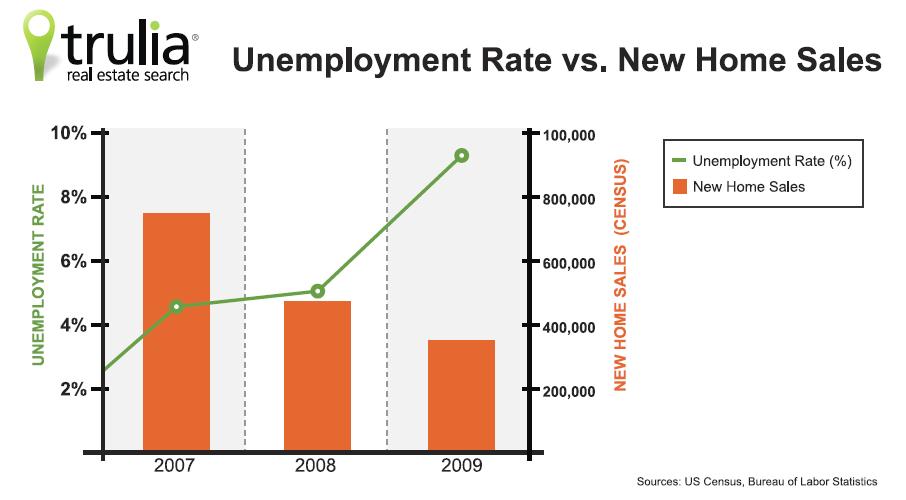

Employment Trends Improving

Initial jobless claims also dropped last week, from a seasonally adjusted 438,000 the previous week to 421,000. This decline exceeded analysts expectations. The drop also brought the 4 week moving average to its lowest point since August 2008.

Employment data is not only important for those looking for a job, it also provides a sense of security to those currently employed. Although interest rates have increased over the past four weeks, they are still considerably lower than the historical norm. However, people concerned about their job security are wisely hesitant to take advantage of these low rates and low housing prices to move into a new home.

Monday, December 6, 2010

8 Ideas for Winter Curb Appeal

- Add splashes of green or purple - Place a small evergreen shrub in a planter or hang a wreath on the door to introduce some color. Plants in the cabbage family can add bright purple tones, a nice contrast to the gray skies of winters in the Northwest.

- Give it seasonal sparkle - Use twigs with red berries or glass balls covered with sparkles to give off a "happy holidays" feeling.

- Make the garden statuesque - Frost-resistant outdoor sculptures are a great way to bring an otherwise dormant garden to life during the winter.

- Light it bright - Get the maximum wattage bulbs for your exterior light fixtures and make sure to keep them clean. If you have showing scheduled in the evening, leave the interior lights on as well. Not only will this keep buyers from stumbling around in the dark, it makes the home seem warm and welcoming from the curb.

- Show off the lifesteyle - Take the cover off your barbecue or the hot tub right before a showing to help buyers picture themselves enjoying these amenities during the summer.

- Make the deck and extension of the house - If you have a covered patio, leave your outdoor furniture out during the winter. Even though you probably won't use it, presenting a nice outdoor living space is a great way to entice buyers.

- Create a photo display of summer days - Using a photo album or digital picture frame, leave some pictures of what your home looks like the rest of the year. Find pictures that show flowers in bloom to let buyers know what they have to look forward to come spring.

- Don't forget to clear a path - On the occasion that we get snow or ice, make sure to shovel a path so that buyers and their agent can get in and out of your house safely.

For more information go to www.realtor.org/realtormag.

Thursday, December 2, 2010

Pending Sales Increase 10%

Dean Maki, Chief Economist at Barclays Capital Inc., said of the new data, "The fundamentals that are driving home sales are low mortgage rates combined with job and income growth and that's why housing should be expected to grow in coming months...housing activity will still look low relative to the boom years, but we expect a solid growth rate to occur."

In Clark County, pending and closed sales dropped in October, so local activitiy does not necessarily reflect national trends. As consumer confidence increases, however, we should see sales data improve in our local area.

Friday, November 19, 2010

Vancouver Parks (Part Four) - Lacamas Heritage Trail

There are parking lots at either end of the trail and at several location in the middle. Check out this interactive map from Google that shows parking and the location of the various amenities the trail has to offer.

Monday, November 15, 2010

Showing Activity Up in November

October Market Report

Compared with September 2010, closed sales declined 10.9% and pending sales fell 2.3%. New listings increased by 2.6%, which caused inventory to rise to 11.1 months of supply. Inventory had decreased each of the previous two months, after jumping to 12 months following the initial closing deadline for the Home Buyers Tax Credit.

Thursday, November 4, 2010

Are You Ready for Winter?

- Have enough supplies for 3 days. This includes non-perishable food (don't forget the can opener!) and at least one gallon of water, per-person/per-day.

- Keep a radio in the house, with extra batteries, to get the latest news/weather reports.

- If the power is out, ATM's may not work, so keep some cash on hand as well.

- Remember the pets! Keep a supply of food and water for them, too.

- Put some personal hygiene items in your emergency kit. You don't want to be stuck in the house for three days with no soap and no toothpaste.

Get a complete checklist for your emergency kit from http://www.govlink.org/storm/prepare.asp.

Tuesday, November 2, 2010

Homeownership Rates Decrease from 2009

The report also contained data about the number of vacant houses in the United States. Last quarter, 2.5% of all residential homes were unoccupied. This figure did not change from the second quarter and was down from last year. The vacancy rate has declined consistently since hitting 2.9% in 2008. Despite the year-to-year decline, the number of vacant houses remains far higher than historical averages. Between 1996 and 2004, the percentage of of vacant houses never surpassed 2%.

The decline in homeownership over the last several years reflects the uncertainty over the future of the economy. When faced with a difficult job market, young people are more likely to rent or live with family than take on the risks of a mortgage. While the First Time Homebuyers Tax Credit may have encouraged some people to buy a home, many would have likely purchased a home even without the tax credit. For those who were either unemployed or underemployed, even with the tax credit, purchasing a home was, and remains, simply not an option.

The vacancy rate could have an impact on the prices of existing homes, especially since it does not include foreclosures not yet listed for sale. According to the National Association of Homebuilders, the building cost per square foot has dropped from its peak of $111.86/ft in 2006, to $92.46/ft in 2009. When coupled with lower land prices, this decrease in the cost to build makes new construction a very appealing option for those who are able to take advantage of historically low interest rates. If this trend continues, it could have deflationary effect on the prices of the growing inventory of homes built more than 10 years ago, that simply can't compete it terms of condition and quality with new construction. Builders also have the chance to tailor their product to match the current trends (master-on-the-main floor, great room concepts, etc.), an opportunity unavailable to existing home owners.

All of this could change rapidly...if the economic recovery picks up steam and creates opportunities for more first-time homebuyers, an increase in demand will reduce inventory and have a postive effect on the prices of existing homes. As stated above, the vacancy rate has dropped from its high point in 2008. If this continued to drop, it will ease the deflationary pressure on existing home prices. In the short term, however, buyers will likely continue to look for bargains on existing homes (short-sales/bank-owned) or new construction.

Monday, November 1, 2010

Vancouver Parks - Part 3 (Esther Short Park)

Today, Esther Short Park hosts the Vancouver Farmer's Market from March through October (last weekend was the last market for this year). During the summer, the park also hosts a summer concert series. Although the "big events" are over, the park is always a great place to get outside and enjoy lunch on one of the occasional dry days during the winter. The park can also be reserved for special occasions.

Esther Short Park is between 6th and 8th Street, just west of Main Street. The park is open from 7 AM to dusk, and there is metered parking on the bordering streets.

Thursday, October 28, 2010

What do the Numbers Mean?

- The National Association of Realtors reported on Monday that existing home sales increased in September compared with August, although they still trailed September 2009.

- According to report released yesterday, new homes sales increased nationally by 6.6%

- This morning, the US Labor Department announced that initial jobless claims dropped to a three-month low.

- Freddie Mac's most recent mortgage rate report put the national average for a 30-yr fixed mortgage at 4.23%, up just slightly from last week's record-low average of 4.21%.

It is important to remember that all of this data is from national reports, which often don't reflect what's going on here in Portland and SW Washington. Even the regional data included in these report don't necessarily describe local conditions, as our region includes both California and Nevada, two states that have been hit particularly hard by the decline in the housing market. Regardless, if this trend of positive data continues, it will likely boost consumer confidence going into 2011.

The two biggest obstacles to recovery in the real estate market are bank-owned/short sale properties, which deflate prices, and concerns over unemployment. If unemployment continues to drop in the two months of 2010, that will be a positive indicator for next year's real estate market. The other challenge, however, does not appear to be going away anytime soon. In Clark County, foreclosed homes accounted for nearly 27% of all home sales between July 1 and September 30.

Historically low-rates and the number of bank owned properties on the market provide great opportunities for first-time homebuyers, or buyers who do not need to sell their current home to purchase. Of course, people need to feel secure in their jobs or they won't be making a purchase as significant as a new home.

Tuesday, October 26, 2010

Dress for Success

Next week, my office will start collecting professional attire to assist low-income women entering the workforce. This is the tenth year that the Hasson Company has participated in the "Send in one Suit" Week. Clothes that are donated go to Dress for Success, a non-profit organization that helps low-income women prepare to enter the workforce. The program is about more than just providing professional looking attire for women who otherwise might not have appropriate clothes for an interview, it also provides training on how to be successful in an interview and ongoing support once a client enters the workforce.

Next week, my office will start collecting professional attire to assist low-income women entering the workforce. This is the tenth year that the Hasson Company has participated in the "Send in one Suit" Week. Clothes that are donated go to Dress for Success, a non-profit organization that helps low-income women prepare to enter the workforce. The program is about more than just providing professional looking attire for women who otherwise might not have appropriate clothes for an interview, it also provides training on how to be successful in an interview and ongoing support once a client enters the workforce. This is a great opportunity for you to go through your closet, find those gently-used business appropriate clothes you no longer wear, and donate them to a good cause. For more information, go to www.hasson.com/dressforsucces.

Friday, October 22, 2010

Vancouver Parks – Part 2 (Lewisville Regional Park)

This is the second part of series featuring one of the more than 130 parks in the Vancouver area. Today's featured is Lewisville Park in Battle Ground.

With over 154 acres of space, Lewisville is the perfect place for the outdoorsy types in Clark County. Cast a line in the East Fork of the Lewis River, or head over to the swimming hold for a quick dip. The covered picnic shelters are large enough to accommodate a large gathering like your next family reunion. There are several miles of trails that run alongside the river and into the surrounding woods and hills. In addition to tennis courts and horseshoe pits, there are several open sports fields for throwing a football or tossing around a Frisbee.

Between March 1 and November 30, the park is open from 7 AM to dusk. Entrance and parking is $3. The rest of the year the park is open only to bicycles and pedestrians, but there is parking just outside the gate. To get to Lewisville Regional Park, go north on SR-503 (about 3 miles north of Battle Ground), then turn right into the park.

Wednesday, October 20, 2010

Impact of I-1098 on Property Taxes

Without taking a side on the issue, I wanted to look at how the measure would impact only of the reform to property taxes. First, a simple explanation of how property taxes are calculated is required: Each year, the State Legislature imposes a Property Tax Levy. The total levy is divided by the total value of the property in the state to determine the tax rate. Both the levy and the tax rate calculation are controlled by various constitutional and statutory requirements and limitations.

State Tax Levy / Total Property Value = Tax Rate

Tax Rate * Your Property Value = State Property Tax Owed

This measure affects only the state property tax, a single component of a homeowner’s total property tax bill. The total property tax owed by an individual also includes county, city, and local school levies. In my most recent tax assessment, my home had an appraised value of $258,600. My total tax due for 2010 was $2,997.05. Of that amount, $523.53 went to the state levy.

Measure 1098 would reduce the state portion of my property tax by roughly 20%, or $105 (the reduction may not be exactly 20%, as various other mechanisms may affect the calculation). I double-checked my numbers with an online calculator provided by the Economic Opportunity Institute, an independent, non-partisan, not-for-profit organization based in Washington State, and they estimated a tax savings of $113 (http://www.eoionline.org/tax_reform/calculator.html).

Bottom Line: For a homeowner with property valued around $250,000, measure I-1098 would reduce their property tax bill by a little over $100.

The property tax component is only one aspect of this measure, and I strongly encourage all voters to carefully read and consider the arguments made by both sides of the issue (http://www.yeson1098.com/ in favor, http://www.defeat1098.com/ in opposition) before casting their ballots.

***This article is not intended to endorse or oppose I-1098, but rather to discuss a singular aspect of the measure: the impact on homeowner’s property taxes. I am not an attorney, tax or otherwise, so this explanation is my best effort to explain the rules governing and the and impact of this measure. If I have mistakenly misrepresented any details, I welcome feedback on the comments section and will promptly make any corrections needed.

Monday, October 18, 2010

Vancouver Parks -- Part 1 (Pacific Community Park)

With over 56 acres, Pacific Community Park has a little something for everyone. Dog lovers can enjoy an 8 acre fenced in dog park. Sports fans can shoot hoops at the basketball courts, kick a soccer ball around the open lawn areas, or drop-in on their skateboard to the 10,000 square foot extreme park. With so much to do, you'll definitely work up an appetite. So, why not take bring a cooler and have lunch at one of the picnic areas? There are both covered and uncovered spaces, available on a first-come, first-serve basis. After lunch take a stroll through the naturally beatiful backyards demonstration garden and pick up some eco-friendly gardening tips.

Parking is available off of NE 172nd Ave, just south of NE 18th St. The park is open from 7 AM to dusk. For more information, go to http://www.clarkparks.org/projects/pacific.htm.

Saturday, October 16, 2010

September Market Report

- Compared with September 2009, average sale price increased 3.6%

- Closed sales increased 11.5% over August 2010

- Month-to-month inventory dropped from 11.9 months to 10.4

- Year-to-date closed sales are up 7.1% over 2009

And the bad...

- Compared with September 2009, closed sales dropped by 23.6% and pending sales decreased 31.6%

- Pending sales dropped 8.3% from August 2010

- In the third quarter of 2010, closed sales fell by 29.9% compared with third quarter 2009

So what does it all mean? While 2010 may end up being a better year than 2009, it likely won't be by much. While closed sales are up year-to-date, the expiration of the homebuyers tax credit led to a very slow third quarter. The next two-and-a-half months will determine whether 2010 improved at all over 2009. Locally, prices appear to have stabilized, which is an important step toward recovery. It remains to be seen what the impact of the foreclosure moratorium by Bank of America will be. The concern is that halting foreclosures will allow "shadow inventory" to build up that will have a negative impact on prices whenever it enters the market.

Bottom line: interest rates are very low and inventory indicates this to be a buyers market, but everyone's situation is different. Until there is recovery in the job market, there won't be consistent growth in real estate.

Wednesday, September 15, 2010

Changes to FHA Loan Program

What does this mean to you?

The lower premium up-front will reduce the overall amount you owe when purchasing or refinancing a home with an FHA loan. For example, on a $200,000 loan, the up-front premium would drop from $4,500 to $1,000. Assuming someone put 5% down ($10,000), the principal due would drop from $194,500 to $191,000. Their montly payments would, on average, increase by about $60.

Friday, September 3, 2010

Fannie Mae Pushing Lenders to Foreclose

If you are behind in your mortgage payments, you have options...but you need to act quickly. Over 2 million homeowners were in foreclosure in July. Give me a call (360-977-8329) and we can talk about your options.

Read the full article here.

Thursday, September 2, 2010

Pending Home Sales Rise

Affordabilty is the combined impact of home priced and interest rates (currently below 4.5% on a 30-yr fixed).

Read the full NAR release here.

Here's an article from Forbes, discussing the news.

Wednesday, September 1, 2010

American Dream Report

- 19% of those surveyed have a more negative view of homeownership than they did 6 months ago, compared with 23% who have a more positive view

- In 1950, the average home was 983 square feet; in 2004, this increased to 2,349 square feet. In the future, most builders say they plan on building smaller, less expensive homes.

- 72% of those surveyed stated that owning a home was part of their American dream

If you would like a copy of the full report, send me an e-mail at johnblom@hasson.com.

Is NAR Counter-productive?

- I don't think that NAR's statements have created an overly optimistic market. Many of the sellers I have talked to recognize that we are still in a difficult market, and that it is going to take awhile to recover. Sure, there are a few that believe their home is worth more than it probably is, but I think this has as much to do with the rapid increase in prices during the housing boom that conditioned people to think a certain way about home values.

- As the other blogger states, NAR is an advocacy group for realtors, so it should not come as a surprise that they tend to emphasize positive news in the real estate market. Consumers should consider where information is coming from when making such an important decision as buying/selling a home.

If you are considering buying or selling a home, I recommend looking at what NAR is saying about the market, but also looking at the Wall Street Journal or the NY Times, as well as the Columbian or Oregonian to get a couple different perspectives. If you have specific questions, call me. For some people, now is not the right time to make a move. If I think you should wait a year or two (or five), I will tell you. I would rather be honest with you and earn your trust (and hopefully your business whenever the time is right), then try and talk you into a bad decision.

Thursday, August 26, 2010

National Existing Home Sales Reports - July

Bad News: Sales of existing homes dropped 27.2 percent to the lowest level in over a decade. Inventory also increased. Anyone who has money in the stock market saw the effects of this when the report was released.

Good News: Home prices continued to increase

The sharp decline of home sales in July was in large part to the expiring tax credit. Many people who planned to buy a home this year purchased in the spring to tax advantage of the First Time Homebuyer/Move-up Buyer Tax Credit. In the Vancouver area, annual sales for 2010 are still higher than 2009. Overall, this year should still be a much better year than last. However, the housing market will not truly begin to recover until unemployment numbers drop.

Saturday, June 5, 2010

Open House -- Sat and Sun 1 to 4 PM

1919 NW 87th Circle

3 bedroom/2.5 bathrooms

2,716 square feet

$384,000

Call or text 360-977-8329 for more details

Wednesday, June 2, 2010

Home Sales Increased in April...

Link to full article

June 2 (Bloomberg) -- The number of contracts to buy previously owned homes climbed in April as Americans took advantage of the last month of a tax credit.

A plunge in mortgage applications signals sales will soften in subsequent months following the April 30 deadline to sign contracts and obtain as much as $8,000 in government assistance. Any sustained recovery in housing hinges on maintaining stability in financial markets and gains in employment in the wake of the European debt crisis.

Thursday, May 6, 2010

Where Buyers Found Their Home

Give me a call to find out more about the tools I use to market and sell your home as quickly as possible and for the best possible price.

John Blom

johnblom@johnlscott.com

(360) 977-8329

Thursday, April 29, 2010

5 Spring Projects

Here's the list, and a quick description. Check out the full article here.

- Gutter Repairs - no one likes to do it, but it has to be done. They suggest using barbecue tongs to try and clean out clogged downspouts.

- Concrete Cracks - a little concrete caulk can take care of little cracks (less than 1/4 inch across). Maintaining your concrete patio or driveway is critical for keeping moisture from getting beneath and causing even more damage.

- Sticking windows and doors - find where the trouble spot is, then carefully remove the window or door and use a hand plane to remove excess material. You can use a power plane, but be careful not to remove too much.

- Paint over water damage - this only works if you use a good primer before applying paint. For best results, use a primer-sealer like Kilz or Zinsser.

- Painting and repairing rusty fixtures - new types of additives for paint allow you to paint directly over rust without getting rid of the rust first. These products prevent further corrosion as well.

Tuesday, April 27, 2010

Move-up/Luxury Market Shows Signs of Life

In the Clark County, pending sales* of entry/first-time/move-up homes (those priced $299,999 or less) were up 60 percent over last March. In the move-up/luxury market ($300,000+), pending sales were up 32 percent over last year. This is clear evidence that the move-up/luxury market is doing comparably well to the broader first-time segment, especially when you consider that this market has not directly benefited from home buyer tax credits like the lower price ranges have.

Why is the move-up/luxury market improving?

• Buyers who are hoping to "time" the bottom of the market

• Low interest rates

• The increased affordability of jumbo loans

At this time last year, interest rates on a jumbo loan were in excess of 8 percent due to a large number of lenders exiting the jumbo market. Today, many of those lenders are returning, which has helped bring interest rates on jumbo loans more in line with conforming loan rates: near 5.5 percent. In addition, Clark County FHA loan limits are up to $418,750, which means that a buyer can purchase a home with as little as 3.5 percent down payment as long as the loan does not exceed $418,750.

With increasing optimism in employment numbers and consumer confidence, as well as the increasing availability of financing products, the housing market recovery should continue at a steady pace. And as we are already seeing, the recovery appears to be taking place throughout the price points, not just in the markets that have been bolstered by tax credits.

*Condos/Single Family. Resale Only. Numbers provided by Trendgraphix.

Friday, April 23, 2010

Website Online

Saturday, April 10, 2010

Open Today -- 2 PM to 5 PM

Vintage tri-level backs to peaceful park.

- Gorgeous oak flooring

- Maple cabinets

- Fresh decor

- Brick fireplace in living room

- Updated vinyl windows

- Eating space with slider to patio

- Back door in laundry room and garage

- Large family room

- 4 bedroom, 2.5 bath

- $195,000

Open Saturday, 2 to 5 PM

Call or text John at (360) 977-8329 for more details

Open House 11 AM to 1 PM

Wednesday, April 7, 2010

Price Reduction

This well-built home sits an an enormous lot (over 10,000 square feet) in a quiet neighborhood, convenient located near I-205, SR-500 and the Vancouver Mall. The three bedrooms all have hardwood floors. The kitchen and one-and-a-half bathrooms need some updating, but this house has great bones.

Call John Blom to schedule your showing (360) 977-8329

Saturday, April 3, 2010

Open House -- Saturday 4/3 -- 1 to 4 PM

Tuesday, March 30, 2010

Internet Showings

JohnLScott.com gets over 350,000 unique visitors per month. Our online property search is the best in the market. I have even heard of buyers who, for one reason or another are working with another broker, but using our site to look for property! We also have thousands of buyers who have signed up for our property tracker program. They get automatic e-mail updates everytime a property comes on the market that fits their criteria.

This all sounds great--but how can you know how much online attention your home is getting? That's where the online showings report comes in. Every week, I e-mail my clients their weekly update, which tells them exactly how many online showings their property received during the week.

If you want to work with an agent who understands today's market and maximizes new technology, give me a call or send me an e-mail to schedule your seller consultation.

Friday, March 26, 2010

New Government Housing Initiative

- Refinancing through FHA with principal reduction for owners who owe more than their house is worth. This part of the program depends on investors who purchased mortgage backed securities accepting a loss. However, the loss might be less than if they had to go to foreclosure.

- Encouraging banks to reduce principal amounts for loans that are underwater. This coincides with an announcement by Bank of America earlier in the week that it would begin forgiving prinicpal on over 45,000 loans.

Read the complete NY Times article here.

Regardless of the politics, what impact might this have on the real estate market? Many people have chosen to walk away from their homes because they believed it would take years for them to get back to a place where they owed less than their house was worth. The option of principal reduction might keep some of these people in their houses. Homeowners who received prinicpal reduction might also be less likely to sell their home as a short sale. If this new program succeeds in shrinking the number of short sales and foreclosures on the market, it would have a positive impact on home values. However, this will only work if banks and investors choose to cooperate on a large enough scale to have a meaningful impact.

Monday, March 22, 2010

Renovation Costs

Here are their estimates for some common projects and a link to the full list:

- New kitchen cabinets - $50 to $100 per linear foot

- Hardwood floors (prefinished) -$10 to $15 per square foot

- Add a patio door - $2000 to $3000

- Reshingle the roof (over existing shingles) - $1 to $2 per square foot

Tuesday, March 16, 2010

February Market Action Report

- Compared with February 2009, closed sales increased 35.1%, while pending sales went up 37%

- Both pending and closed for February increased from January, with pending up 27.3% and closed up 10.6%

- Based on current active listings and sales trends, inventory is currently at 11.6 months, down from 18.6 months in February 2009

If you would like a copy of the complete Market Action Report, e-mail me at johnblom@johnlscott.com.

Thursday, March 11, 2010

Battle Grounds Coffee

Move to Former Church Proves Heavenly

By Karen Persson for the Columbian

Why: If you’ve never had a reason to check this place out, the new location will likely pique your interest. A mere half a block from its former location, Battle Grounds Coffee House has taken up residence in a building that was established as a Catholic church in 1928. The coffee house still serves Stumptown brews, but it has added Premium Boar’s Head deli meats to expand the lunchtime options.

Atmosphere: With the additional space that came with the new address, the coffee house has more family appeal than it used to. Seating extends onto an outdoor porch for enjoying those warm weather days that are just around the corner. The building still has a churchy feel, with cathedral-style windows trimmed in green glass and a wood floor, but the altar has been replaced with a cozy electric fireplace, leather sofas and club chairs. The coffee house also has meeting rooms downstairs for large groups.

Tuesday, March 9, 2010

2010 Property Tax Statements

As many in Washington have seen their property values decrease, it’s not unreasonable to expect that property assessments would go down as well. However, that’s not always the case. In the state of Washington, approximately half of your property tax is determined by levies for schools and community services.

While you can’t do much to avoid paying property taxes, if you disagree with the value your local assessor has placed on your house, you are entitled to an appeal. For more information about appealing your home’s assessment, as well as the petition form you will need to fill out go to http://dor.wa.gov/content/findtaxesandrates/propertytax/

If your property assessment has piqued your curiosity about the value of your home, please feel free to contact me. I’d be happy to discuss a comparative market analysis of your home, and, if appropriate, a property marketing and price strategy plan.

Saturday, March 6, 2010

Open House -- Saturday 11 AM to 2 PM -- Washougal

1698 N 9th St

Washougal, WA

Call or text (360) 977-8329 for more details

Tuesday, March 2, 2010

Tax Tips from Houselogic.com

"In general, individuals and couples filing jointly can deduct the interest on up to $1 million ($500,000 if you’re married and filing separately) in combined home loans, as long as the money was used for acquisition costs, that is the cost to buy, build, or substantially improve a home."

Read the full article here. And of course, be sure to consult with a tax professional if you have questions.

Friday, February 26, 2010

Two Months Left on the Tax Credit

Qualified homeowners who have lived in their current home for at least five of the past eight years are eligible for a $6,500 tax credit to buy a home.

· Tax credit does not require repayment.

· Credit is available to couples with gross income of less than $225,000 and individuals making less than $125,000.

· Credit is limited to homes priced $800,000 or less.

· The home must be purchased as the primary residence.

· Buyers must secure a binding contract by April 30, allowing 60 days to close.

It is estimated that approximately 70 percent of home buyers qualify for some kind of tax credit when they purchase a home. If you’d like to find out whether you are one of them, please contact me.

New Listing -- 52 Acres -- Great Development Opportunity

Thursday, February 25, 2010

Open House -- Sunday 2/28 -- 1-4 PM

2012 SE 178th Ave

johnblom@johnlscott.com

Call or text (360) 977-8329 for more information

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

Open House -- Saturday 2/27 -- 1-4 PM

6606 NE 51st Circle

MLS #10011881

johnblom@johnlscott.com

Call or text (360) 977-8329 for more information